direct vs indirect cash flow gaap

The cash flow statement is divided into three categoriescash flows from operating activities cash flows. The difference between these methods lies in the presentation of information within the cash flows from operating activities section of the statement.

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

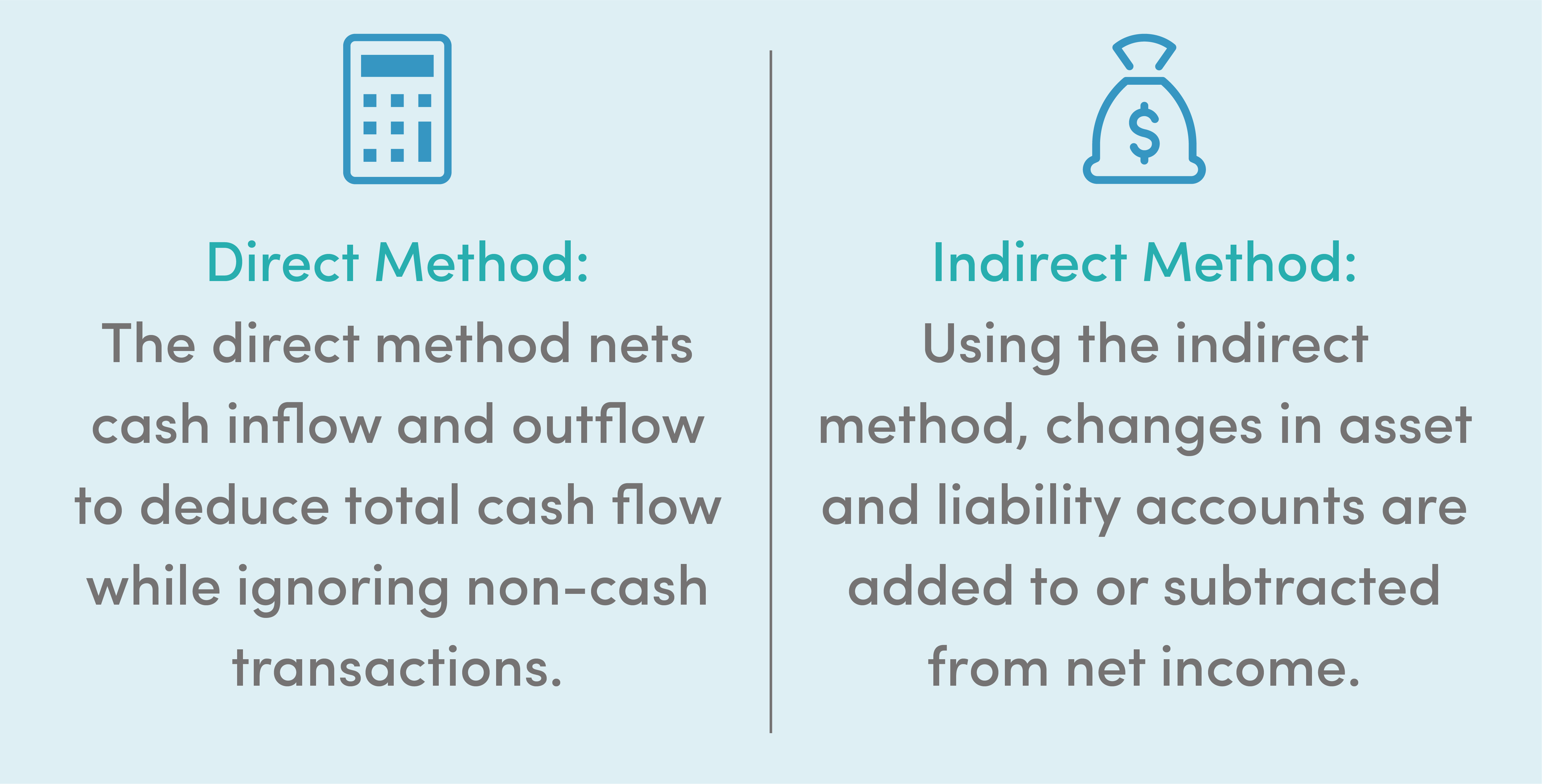

Under the direct method you present the cash flow from operating activities as actual cash outflows and inflows on a cash basis without beginning from net income on an accrued basis.

. Either the direct or indirect Net income must be reconciled to net cash flows from operating activities if the indirect method is used. The direct method of cash-flow calculation is more straightforward and it shows all your major gross cash receipts and gross cash payments. Also if a company.

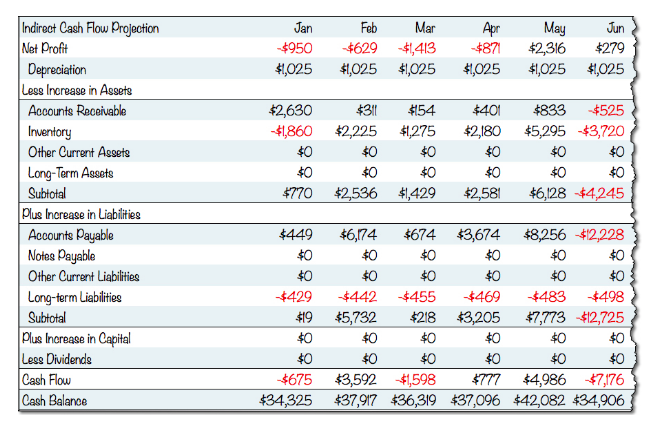

The indirect method backs into cash flow by adjusting net profit or net income with changes applied from your non-cash transactions. Both IFRS and US GAAP encourage the use of the direct method but will allow either method to be used. The main difference between the direct and indirect cash flow statement is that in direct method the operating activities generally report cash payments and cash receipts happening across the business whereas for the indirect method of cash flow statement asset changes and liabilities changes are adjusted to the net income to derive cash flow from the operating activities.

The investing and financing categories are treated the same under both methods. Operating investing aka discretionary and financing. US GAAP allows businesses to choose the direct or indirect method but even when using the direct method a reconciliation of cash flow from operating activities to net profit net income is required.

US GAAP also requires similar adjustments. The direct method starts with sales and follows cash as it flows through the income statement while the indirect method starts with income after taxes and adjusts backwards for noncash and other items. Both the Direct and Indirect methods require that cash flows be classified into three categories.

Under US GAAP however when companies use the. The main difference between the direct and indirect methods of calculating cash flows is the way that cash flow from operations is calculated. GAAP also calls the indirect method the reconciliation method.

Direct and Indirect Methods Cash from Operating Activities. Under this method net cash provided or used by operating activities is determined by adding back or deducting from net income those items that do not effect on cash. 108 In addition unlike IFRSs US.

The direct method and the indirect method are alternative ways to present information in an organizations statement of cash flows. Up to 5 cash back IAS 7 and Section 230-10-45 FASB Statement No. Many US corporations use the indirect method so this method should be known.

The key difference between direct and indirect cash flow method is that direct cash flow method lists all the major operating cash receipts and payments for the accounting year by source whereas indirect cash flow method adjusts net income for the changes in balance sheet accounts to calculate the cash flow from operating activities. Statement of cash flows resulted from the efforts and ideas of various RSM US LLP professionals including members of the National Professional Standards Group as well as. Cash flows from investing activities and cash flows from financing activities are the same for a company regardless of whether the direct method or indirect method is used.

The direct method and the indirect method. 106 Both encourage the use of the direct method. The following are the common types of adjustments that are made to.

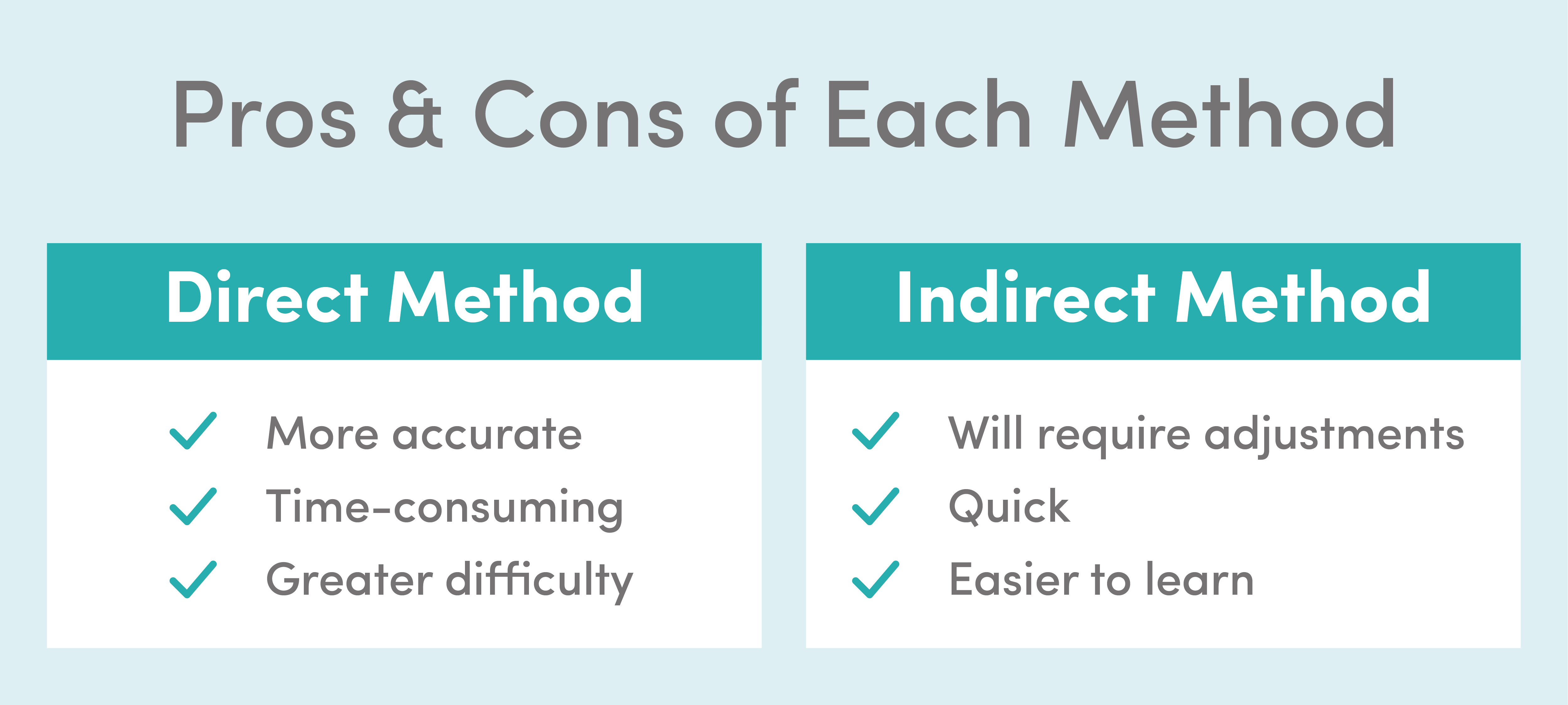

Comparing the Direct and Indirect Cash Flow Methods. The main difference between the direct method and the indirect method of preparing cash flow statements involves the cash flows from operating expenses. Cash flow from Operating Activities may be reported in either one of these two presentation formats.

Indirect Method vs. 95 permit the direct and the indirect method of reporting cash flows from operating activities. The direct method takes various cash activities receipts from customers.

For example if a retailer sells an item on credit the indirect method will consider this as income and reflect this in the figures whereas the direct method wont include it until the bill has been paid. The indirect method on the other hand focuses on net income and may include cash that is not yet in the business. However if a company used the direct method it is also required to show reconciliation between net income and cash flow from operations.

Operating activities however are treated very differently. Note that in the US the indirect method does not start with profit before tax but rather with net. Indirect method is the most widely used method for the calculation of net cash flow from operating activities.

GAAP requires a reconciliation of net cash flow from. There are no presentation.

Pin By Kristina Monroe On Crafts Accounting Education Accounting Learn Accounting

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

What Is The Difference Between The Direct And Indirect Cash Flow Statement Methods Universal Cpa Review

Direct Vs Indirect The Best Cash Flow Method Vena

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Difference Between Direct And Indirect Cash Flow Compare The Difference Between Similar Terms

The Direct And The Indirect Method For The Statement Of Cash Flows Online Accounting

The Essential Guide To Direct And Indirect Cash Flow Cash Flow Cash Flow Statement Learn Accounting

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Pin On Quotes Nyibutsa Ibyingenzi

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Cost Accounting Ebook Rental Cost Accounting Accounting Education Accounting

Direct Vs Indirect Method Statement Of Cash Flows Youtube

Statement Of Cash Flows Direct Method Format Example Preparation

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal